Until 2012, the “Oatly” brand (oat-based milk substitute) was positioned more in the lactose-free product segment. This purely functional market positioning was then abandoned in order to take up an ethically based market position with the beginning boom of the vegan dietary style. This is reported by Peter Wennström, Healthy Marketing Team, today at the online trade fair Fi Europe CONNECT. From this position, Oatly is able to pursue a far-reaching attack strategy against original dairy products. In addition, “vegan” is perceived by many consumers today as the healthier diet.

Until 2012, the “Oatly” brand (oat-based milk substitute) was positioned more in the lactose-free product segment. This purely functional market positioning was then abandoned in order to take up an ethically based market position with the beginning boom of the vegan dietary style. This is reported by Peter Wennström, Healthy Marketing Team, today at the online trade fair Fi Europe CONNECT. From this position, Oatly is able to pursue a far-reaching attack strategy against original dairy products. In addition, “vegan” is perceived by many consumers today as the healthier diet.

Since 2018, the big players in the FMCG business have increasingly been dealing with vegan products. Reason for this is that they either see their sales potential threatened or recognise new sales opportunities. According to Wennström, health and sustainability are the main arguments of vegan substitutes today. Even today the market is already open to vegan mass products in some areas. As is already the case with original products, the trend towards “pure” or “free from…” is also becoming more and more apparent in the alternative products. This is accompanied by a shift of the discussion from vegetable vs. conventional to purity vs. high processing.

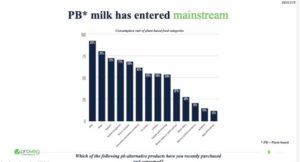

The importance of the current development in the vegan market is illustrated by the commitment of large investors in this market. Oatly has been provided with $200 million in capital for further expansion, among the investors are names like Blackstone. By 2024, according to Albrecht Wolfmeyer, Proveg Incubator, global sales of plant-based milk alternatives are expected to grow to $21.5 billion (CAGR + 10%). This applies not only to North America but also to Europe: 93% of European consumers have already bought vegan milk alternatives. The situation is quite different for cheese, however: global sales of cheese amount to $114 billion, while in the USA, vegetable cheese alternatives only generate sales of $189 million.