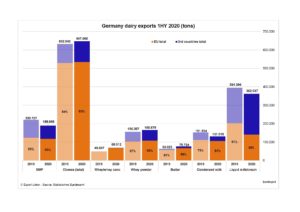

According to the association of German dairy exporters EXU, 1HY export volumes of important products such as cheese, milk-based drinks, butter and whey products topped last year’s results, in some cases considerably. Cheese achieved a plus of 2.4 percent, butter even an increase of 20 percent.

Overall, the popularity of German cheese is encouraging: almost 650,000 tons were sold outside the German border. In the two previous years, the figure was around 630,000 tons. Third-country markets have provided a considerable boost, demand is almost 10 percent higher than in the previous year. That is now 112,400 tons of cheese leaving the EU from Germany. In North Africa, Algeria (2,000 tons) and Libya (2,800 tons) in particular demanded German cheese, while South Africa (-49 percent) remained subdued. Chile has also ordered around 10 percent less so far this year, at just under 4,200 tons.

Click to enlarge graph

Overall butter sales reached very good export volumes during the period under review. In the previous months the increase over the previous year was even greater in some cases. In 1HY, about 76,000 tons of butter were exported, which is practically the same as the result of the two very good years 2015 (76,600 tons) and 2016 (77,700 tons). At 67,500 tons, the EU neighbors ordered considerably more (+18 percent) than in the previous year. Saudi Arabia apparently has special needs this year and increased the quantity by around 900 tons. However, Saudi Arabia is currently at a comparatively low level of 1,100 tons, but is the most important third country partner. South Korea increased its import volumes of German butter from 430 tons to 870 tons, as did the United Kingdom (+13 percent/ 584 tons). In contrast to Japan, where volumes fell from 1,100 to just under 500 tons.

Whey powder remained at 166,000 tons, about 10,000 tons above the previous year. On the one hand, more quantities to the Netherlands (16,000 tons), and on the other hand, China has also shown more interest again. For whey concentrate, which is actually only traded with neighboring countries in the EU, the statistics show an increase of 20,000 tons.

In other product segments, however, the picture is divided.

Exports of milk and cream in small packages to neighboring EU countries fell by 30 percent, while sales outside the EU increased by 15 percent. Remarkable is the 22 percent increase in exports of liquid milk to China (157,800 tons), although there had been significant logistical problems in the context of the Corona pandemic. The overall trade deficit for this category is 8 percent compared to the same period last year. However, the declining EU demand for liquid milk is by no means a corona-related result. Volumes have been falling sharply for several years, especially to France, the Netherlands and Italy. This trend has continued this year. A role is certainly played here by origin labelling, which is patriotically handled by some Member States, while Germany continues to rely on labeling only EU origin.

However, this year exports of bulk milk to neighboring EU countries (-7.6 percent) have also fallen significantly, including to Italy (-20 percent). Exports of bulk milk to the Netherlands and Denmark remained stable. Demand increased by 40 percent, but remained below 40,000 tons.

Things did not go so well for German condensed milk (unsweetened) either: 5 percent less sales volume in the EU and 37 percent less in third countries meant that the previous year’s result was missed by around 20,000 tons (-13.7 percent) overall. The volume in third countries accounts for about one fifth of the total volume. In the EU, it was mainly Portugal that prevented even worse figures. At 32,000 tons, 6,500 tons more were delivered there than in the first half of 2019. At 11,000 tons, the Asian region was about 4 percent down on the previous year, but this is a much better result than in the previous months of this year. Cumulated in the first three months, the decline amounted to almost 36 percent.

Demand for SMP has not yet reached the level seen in the first half of 2019, and although the shortfall has also been reduced in recent months, around 30,000 fewer tons have been exported from Germany to date. At around 190,000 tons, the half-year result of 2015 (187,000 tons) has been reached.

Outlook

The effects of the corona pandemic have posed major challenges for German dairies and their trading partners. International trade in dairy products has remained largely stable despite the massive negative economic effects, and the dairies have played their part in providing people with a secure supply of high-quality food. However, due to the loss of foodservice customers, products had to be sold more cheaply at home and abroad than a year ago. The competition between dairies is and remains fierce even in the corona crisis. The bottom line is that although the milk volumes from Germany were generally well managed thanks to strong sales in third countries, unfortunately much less has remained in the coffers of the dairies. This is also reflected in the lower milk prices of German dairies.

The pandemic is not over and will continue to affect global commodity flows. Against the background of the general economic conditions, increasing payment risks in the export business and due to the weak currency relation to the dollar and low oil prices, the situation for the dairy industry will remain difficult for the foreseeable future.

Photo: pixabay