US financial services provider StoneX today gave a Global Dairy Market Outlook. While milk prices in the EU are moving towards ever new records, they are falling in Oceania due to weaker export demand. In the US, milk production is down 1%, logistics problems prevent the dairy industry from benefiting sufficiently from high prices in the world market.

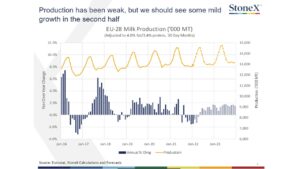

A further increase in milk prices is expected in the coming months, but milk producers will not react until the higher product revenues translate into a noticeably higher cash flow for them. At the moment, farms are facing significantly rising input costs, and overall a significant increase in production is not expected for 2022.

A further increase in milk prices is expected in the coming months, but milk producers will not react until the higher product revenues translate into a noticeably higher cash flow for them. At the moment, farms are facing significantly rising input costs, and overall a significant increase in production is not expected for 2022.

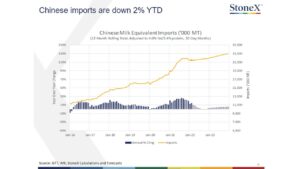

A switch by processors to plant-based raw materials – the common reaction to high dairy prices – is only possible to a limited extent, because plant-based ingredients are also becoming noticeably more expensive, and there are also ongoing problems with transport capacities. China has relatively high stocks, and the government’s zero-covid policy there is making sales and imports difficult (lockdowns, closure of ports). From StoneX’s perspective, China will remain a difficult market this year, with imports currently 2% below last year.

A switch by processors to plant-based raw materials – the common reaction to high dairy prices – is only possible to a limited extent, because plant-based ingredients are also becoming noticeably more expensive, and there are also ongoing problems with transport capacities. China has relatively high stocks, and the government’s zero-covid policy there is making sales and imports difficult (lockdowns, closure of ports). From StoneX’s perspective, China will remain a difficult market this year, with imports currently 2% below last year.

StoneX sees a turnaround in prices from the summer onwards at best, but it will not be very strong; product and milk prices will remain high for the next up to three years.