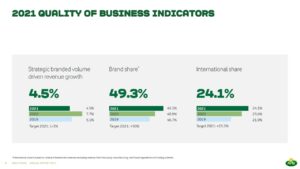

Arla Foods delivered a solid performance throughout 2021 despite continued disruptions from the pandemic and renewed market volatility created by high inflation. The company delivered branded growth and returns to its farmer owners at the top end of expectations. Total Arla Group revenue increased by 5.6 per cent to EUR 11.2 billion driven mainly by higher sales prices and strategic branded sales growth of 4.5 per cent.

Arla’s performance price – which measures the value Arla Foods creates per kilogram of owner milk – was 39.7 eurocent in 2021 compared to 36.5 eurocent in 2020.

Arla’s farmer owners were again challenged throughout 2021 due to rising costs and additional requirements on their farms. Arla maintained a competitive pre-paid milk price that increased by 23% throughout the year.

Growth in commercial segments

Arla Europe increased revenue to EUR 6,621 million compared to EUR 6,413 million in 2020 and continued to gain market shares in the majority of the European markets with a strong branded portfolio, delivering year on year market share improvement of 0,3% across categories and despite fewer in-home meal occasions as lockdowns lifted. Arla Europe delivered an overall branded volume driven growth of 2.3 per cent on top of last year’s exceptional growth of 5.9 per cent.

Arla Europe increased revenue to EUR 6,621 million compared to EUR 6,413 million in 2020 and continued to gain market shares in the majority of the European markets with a strong branded portfolio, delivering year on year market share improvement of 0,3% across categories and despite fewer in-home meal occasions as lockdowns lifted. Arla Europe delivered an overall branded volume driven growth of 2.3 per cent on top of last year’s exceptional growth of 5.9 per cent.

Arla International delivered branded volume driven growth of 9.1 per cent on top of last year’s 11.6 per cent. In addition to pricing, International grew market share in key positions for Puck ® in the Middle East and North Africa (MENA) where it became the number one spreadable cheese brand and for Arla ® Dano in Bangladesh, which won best milk brand for the 7th year in a row. To support continued growth and expansion plans for the MENA region, Arla invested in its production capabilities for processed cheeses, on-the-go Starbucks® and Puck® cooking cream and sauces in its sites in Bahrain and Saudi Arabia. Overall, International revenue increased to EUR 2,101 million compared to EUR 1,975 million in 2020.

Arla Foods Ingredients (AFI), a 100 per cent owned subsidiary of Arla, grew its value-add segment by 14.5 per cent and delivered increased revenue of EUR 794 million compared to EUR 716 million in 2020. Significant increases in raw material and energy prices challenged margins. Due to strong global demand and price increases, especially in the second half of 2021, Global Industry Sales increased revenue of EUR 1,686 million compared to EUR 1,541 million, despite a lower share of milk due to increased sales through Arla’s retail channels.

Arla Foods Ingredients (AFI), a 100 per cent owned subsidiary of Arla, grew its value-add segment by 14.5 per cent and delivered increased revenue of EUR 794 million compared to EUR 716 million in 2020. Significant increases in raw material and energy prices challenged margins. Due to strong global demand and price increases, especially in the second half of 2021, Global Industry Sales increased revenue of EUR 1,686 million compared to EUR 1,541 million, despite a lower share of milk due to increased sales through Arla’s retail channels.

Arla plans to invest EUR 600 million in 2022, mainly in structural investments such as expanding Starbucks production capacity at Esbjerg Dairy in Denmark, finalizing the powder tower in Pronsfeld in Germany and the mozzarella expansion at Branderup dairy in Denmark, along with production expansions in AFI’s production sites. Arla also plans to invest in further digitalization solutions in supply chain.

Group revenue outlook for 2022 is expected to be EUR 11.8-12.4 billion, net profit share will be in the range of 2.8 to 3.2 per cent and leverage is expected to be in the range of 2.5-2.9.

Arla will publish its Annual report, ESG report and CSR report on February 24th.