This year’s International Whey Conference was supposed to take place ein Dublin, Ireland. However, Covid-19 changed things completely. The IWC is being held as an triple online event with the support of Teagasc, the Irish Agriculture and Food Development Authority. The first part of the IWC, entitled „International Whey Sector: current and future state, and the ‚whey‘ forward“ took place today, 13 November. Being an online event, however, did IWC’s popularity no arm: there are over 500 registered participants.

Session moderator Fraser Tooley, Strategy Consultant to the global B2B dairy ingredients industry, pointed out the enormous economic importance of whey. In fact, he said., whey is one of the leading wealth generators in the food ingredfient world. Every day, a billion consumers eat whey in one or another form. The total worth of products that contain whey is more than $100bn worldwide while the industries B2B whey business totals $8.5bn p.a..

Session moderator Fraser Tooley, Strategy Consultant to the global B2B dairy ingredients industry, pointed out the enormous economic importance of whey. In fact, he said., whey is one of the leading wealth generators in the food ingredfient world. Every day, a billion consumers eat whey in one or another form. The total worth of products that contain whey is more than $100bn worldwide while the industries B2B whey business totals $8.5bn p.a..

Corona and communication

Ingo Müller, CEO DMK, decribed the effects Corona had on Germany’s largest dairy company. All in all, the supply chain survived and things could have gotten much more problematic. One thing, Müller takes as a lesson from the pandemic is that security of supply has a vital role in time of crisis. The dairy industry has proven itself so far and will come out of Covid-19 with more strength. Covid, Müller said, was just one of the problems that the year 2020 presented to the industry. There’s also Brexit and growing protectionism. The challenges for the dairy sector are not smaller than those posed to the car industry by e-mobility, Müller added. In this context, Müller thanked the Brexit working group within EDA for presenting the interests of the joint European dairy industry together with that of the UK to policy makers.

Ingo Müller, CEO DMK, decribed the effects Corona had on Germany’s largest dairy company. All in all, the supply chain survived and things could have gotten much more problematic. One thing, Müller takes as a lesson from the pandemic is that security of supply has a vital role in time of crisis. The dairy industry has proven itself so far and will come out of Covid-19 with more strength. Covid, Müller said, was just one of the problems that the year 2020 presented to the industry. There’s also Brexit and growing protectionism. The challenges for the dairy sector are not smaller than those posed to the car industry by e-mobility, Müller added. In this context, Müller thanked the Brexit working group within EDA for presenting the interests of the joint European dairy industry together with that of the UK to policy makers.

Müller highlighted the importance of communication from a higher-level for the industry. The German dairy industry has just decided to finance a sector-wide communiaction that makes the industry speak with one voice putting scientific facts against unscientific criticism and attacks. In the past, the dairy industry was too passive in the public discussion around animal welfare, milk and environment and health aspects of dairy consumption. There were too many individual campaigns that just cost money and credibility. In fact, the image of dairy has become poorer and poorer over the years, especially with younger generations, which worries Müller a lot, as he committed. These times are over now as Germany will adopt a shared industry communication from 2021.

Commoditisation and premiumisation

Kevin Bellamy, Global Head Dairy at Rabobank, agreed that 2020 – „a year to remember“ – could have been much worse than it was. Covid was just one element on the top of a multitude problems for ecomomy and dairy, like the Asian Swine Fever or political trouble in Hong Kong, the entry of babyfood products for the Chinese market.

Kevin Bellamy, Global Head Dairy at Rabobank, agreed that 2020 – „a year to remember“ – could have been much worse than it was. Covid was just one element on the top of a multitude problems for ecomomy and dairy, like the Asian Swine Fever or political trouble in Hong Kong, the entry of babyfood products for the Chinese market.

While 2020 will be no boom year for whey derivative,s prices have tended downwards over the past 5 years anyway. This erosion was due to the fact that ever more whey is being processed and that many players have upgraded their capacities. Bellamy spoke of commoditisation of once added-value products. For instance, WPC 80 was selling at a discount compared to other whey protein products in the past years.

click to enlarge:

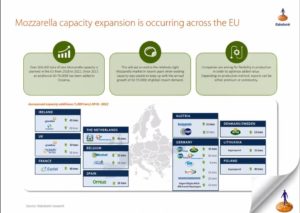

Meanwhile, cheese sales are growing by 2.2% worldwide every year. This brings even more whey. Bellamy estimated that alone the increase of European mozzarella production capacities (+ 500,000 tons until 2022) will generate 3m tons of white whey in addition. Worldwide, the growth of cheese production adds some 25,000 tons of whey solids to processing every year.

Whey products traditionally end up in infant formula. China has been the driver of international sales of infant formula for many years. But the birth rate in China is decreasing. It peaked in 2016 with about 20 million new born babies and has decreased to about 5 million in 2018. The big players in infant formula developed premiumisation as a concept to keep margins. They have started to buy specialist small companies in the field of infant nutrition to make their offering distinguishable. But margins will erode soon, Bellamy warned. In the longer run, China will develop into an importer of ingredients rather than of finished products when it comes to infant formula.

Another growth area for whey ingredients is sports nutrition. It generates sales of $12bn in North America, $3.2bn in Europe and $2.2bn in Asia. Growth rates are solid.

Fueled by Corona, health promoting products containing whey are experiencing a boom. The market in Asia is worth $90bn with a CAGR of 5.8%. North America’s health foods generate $30bn in sales with a growth rate of 0.7% while West Europe stands for $20bn with a growth rate of 2.4%.

A certain danger comes from plant-based „milks“ whose sales have grown from 1.9bn liters in 2014 to 2.9bn liters in 2019 (with soy as a raw material basis decreasing from 53% to 33%). This development, Bellamy said, might bring the whey processing industry under trouble, albeit only to a limited extent. Fermentation-derived proteins will possibly only take a small part of the protein market as there are currently only small players and start-ups around who make little or no money. Consumers will take a long time to accept that kind of protein, Bellamy said.

The next part of IWC 2020 will take place on 4 December and deal with technology.